![]()

INDUSTRY INNOVATION – THE RISK DATA OPEN STANDARD

The Risk Data Open Standard (RDOS) is a flexible modern data schema that will drive value and innovation through many parts of the industry. The RDOS is an open standard, which means you can have the code, tooling, and documentation to leverage this technology in your organization, and you can contribute to make our industry better.

![]()

JOIN A THRIVING COMMUNITY

Dynamic communities are the cornerstone of open standards. The RDOS is supported by resources to help build communities that drive high-impact open projects. Join us at the RDOS Github project and contribute to the future of our industry!

The RDOS is not locked into any specific technology and can be physically implemented in different manners. The ultimate form of the RDOS is as an object-relational construction, but it can also be implemented in SQL and flat file formats. Different platforms will use the physical implementations that best meet their needs. Tooling will be provided to help implement the RDOS using the technology that suits you best.

The RDOS solves many pain points that modeling practitioners have struggled with for decades and it paves the way for the future of risk modeling. What are some of its advantages?

- A clearer and more flexible representation of exposure and coverage.

- A complete view of how exposure was analyzed and what settings and models generated results.

- Powerful new ways to express contract terms and the business structures that they apply to.

- Modular design that makes adding information simple, such as new modeling approaches and even new lines of business.

- Technical flexibility to store any type of data – not just relational tables.

- An open standard that changes with industry needs and is guided by real world practitioners.

RDOS is backward-compatible with formats such as the EDM (Exposure Data Model) and the RDM (Results Data Model), so you can easily convert EDMs/RDMs to RDOS format.

Try sample RDOS Conversion Tool

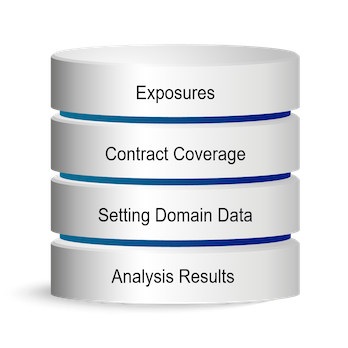

The RDOS stores exposure and financial data in distinct areas, which makes it possible to correct shortcomings in financial modeling, and also facilitates changes required by new models or model updates.

Current data models put exposure and results in separate containers. For example, the RMS EDM contains exposure and contract terms and the RDM contains modeling results. There is limited information about how models were used to produce the results. This incomplete picture of the analysis is confusing to consumers of the information – leading to potential misunderstanding of the analysis and to inefficient processes that need to work around the shortcomings of the information. The RDOS contains exposure and results in the same construct, and adds more complete information about model setting, linkage between exposure and results, and other domain data – providing a clearer picture of how analysis results were derived.

A new generation of higher definition models requires larger input and output data sets and can generate results that are structured differently from the existing algorithms. Models that address new classes of business, such as cyber, have data requirements that are radically different from traditional property cat models. As modeling options multiply, however, modeling efficiency can plummet as users process too many data formats, and contend with ever-increasing interface requirements. As a remedy, the re/insurance industry needs a single container for exposures and results from any model fit into a single exposure or results format. Rather than attempting to shoehorn unlike data into the old constructs for new models, the RDOS is a universal container with the flexibility to suit the new models and products being created throughout the industry.

The best approach to financial modeling uses a language-based description of contract terms. The RDOS uses Contract Definition Language (CDL) to build contract terms and conditions that can represent virtually any policy, treaty, or insurance-linked security.

Financial modeling is further complicated by the need to refer to business structures. This is particularly the case when describing reinsurance programs, where the subject of a given treaty can be the net of losses that come from combined business units, perils, and inuring reinsurance. Because there is currently no way to represent business hierarchies or complex contract interaction within the modeling framework, building an analysis that combines results and properly applies coverage is often difficult and poorly documented – resulting in wasted time and a greater likelihood of errors. Structure Definition Language (SDL) is a new invention that documents and automates the creation of company-specific financial perspectives – creating significant value and efficiency.

Because the RDOS is a NoSQL construct, it can store language – enabling these new financial modeling solutions. However, CDL and some aspects of SDL can be converted to a tabular format, and the RDOS can also store financial terms and conditions in a tabular form.

Re/insurers increasingly seek to apply enhanced pricing and exposure analytics to lines of business beyond property catastrophe. Existing schemas are very difficult to extend to new classes of risk and associated coverage, but the RDOS is designed to facilitate the addition of new lines of insurance or risk with minimal disruption and effort.

A broad industry work group called the Global Exposure And Clash (GEAC) project created schemas for 14 lines of insurance. Each line has a different set of fields that describe the risk characteristics that are key to analyzing and underwriting that particular type of risk. The RDOS is capable of accommodating these new schemas.

CDL is a patented domain-specific language created by Risk Management Solutions, Inc. CDL is used for defining how much a contract pays out, given a set of discrete claims. It uses a vocabulary that is familiar to insurance industry professionals and a structure that is precise to computational engines. CDL is:

- Transparent - Concise natural language is readable by insurance professionals.

- Unambiguous - Strong semantics guarantee the calculation that is expected.

- Flexible - No fixed schema means CDL can express a wide variety of contracts and can expand to cover more.

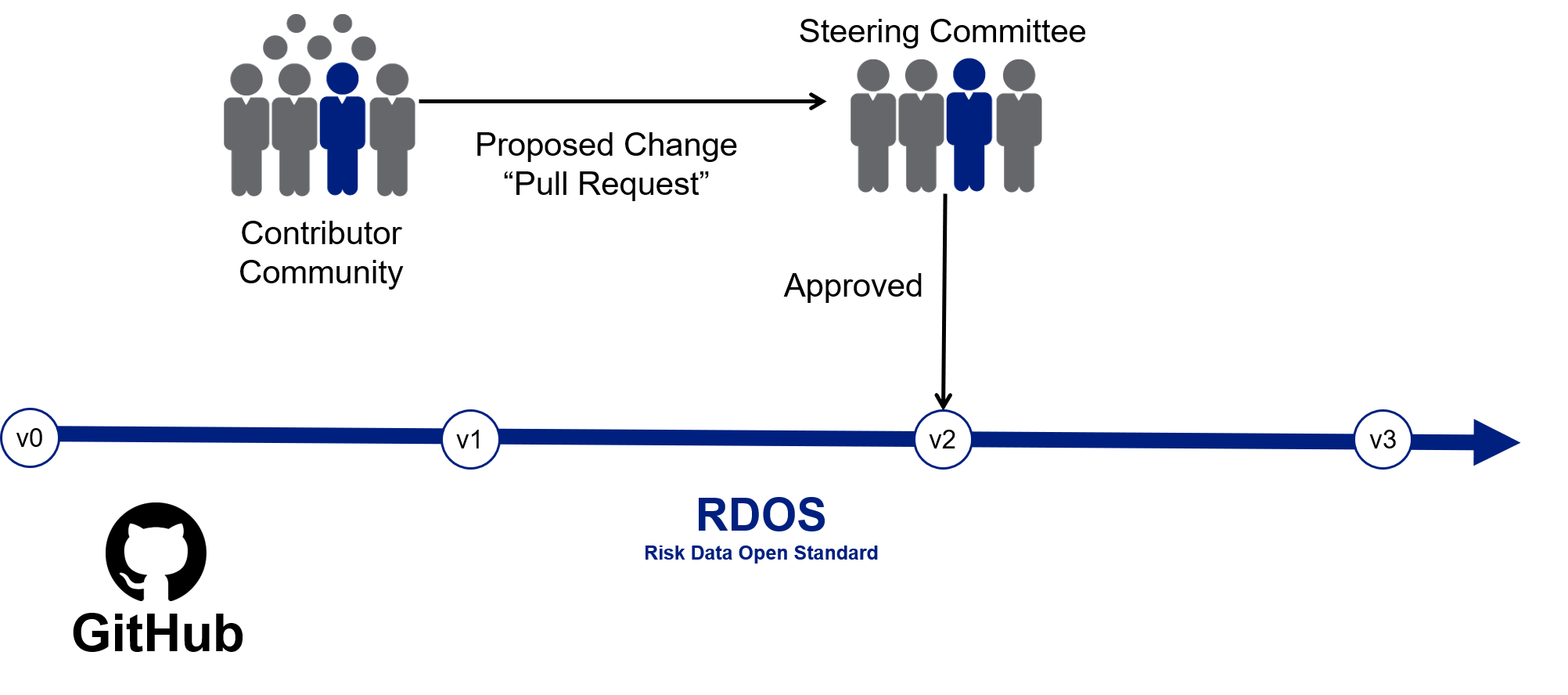

Solid, transparent governance and an inclusive philosophy will attract the largest ecosystems of contributors and users. Open standard governance assesses new ideas and requests for changes to determine whether they add value and suit the industry and technology. At the core of the open standards process is the contribution and change request process (called pull requests), and the Steering Committee.

How to Contribute to the Risk Data Open Standard (RDOS)

It is an exciting time for the insurance and wider risk management industry. As of January 31, a new asset for the industry – the Risk Data Open Standard (RDOS) has been made publicly available on GitHub, the largest host of source code in the world…

Industry Collaboration for a Better Data Standard

Data - the buzzword of the decade. The world understands its value, but the insurance industry has not only lagged behind in exploiting data, it has also created huge inefficiencies in how it is handled and exchanged. At RMS, we believe that no single company is going to solve this problem – it will take collaboration...

RMS and the Risk Data Open Standard Committee Announce Availability of RDOS

RMS and the Risk Data Open Standard Steering Committee today announced that RDOS code is now available for download from the leading open source public repository...

Creating an Open Standard for Risk Data with Risk Data Open Standard (RDOS)

The Risk Data Open Standard (RDOS) Steering Committee that guides and oversees this standard has been busy in 2019 working to shape the RDOS, to enable the risk industry to simplify risk management and risk data portability. The RDOS has traveled a long journey and is now proudly an open standard...

A New Data Standard - RDOS Overview

In this presentation you will learn, what problems are we trying to solve with an open standard, what is RDOS, why is this approach better than anything in the market and the benefits you can derive, what is available today and how is governed.

Successful Open Source Projects

This presentation covers the challenges today with proprietary standards, why RDOS is an open standard, how successful open-source projects work, and the licensing approach that we are taking with RDOS to help create a successful and living standard.

What Can You Do With RDOS?

This presentation drills deeper into how RDOS delivers value to organizations by providing a deeper understanding of risk at a lower cost. It defines compliance and therefore can be used to exchange information by enabling model interoperability.

Github

GitHub is a development platform inspired by the way you work. From open source to business, you can host and review code, manage projects, and build software alongside 40 million developers. RMS has put the Risk Data Open Standard in Github where you can contribute to the industry.

Help Center

The Help Center provides more information to help with your RDOS adoption. This includes explanations of the RDOS concepts and building blocks, entity relationship diagrams, and the full RDOS schema in xlsx format.

.jpeg)